Every business knows the pain of the “last mile” in a digital transaction. A customer finds a product they love, adds it to their cart, and begins the checkout process. They are seconds away from completing a purchase, but then they are confronted with a wall of forms, a series of tedious clicks, and a clunky, impersonal interface. They hesitate, they get distracted, and they abandon the cart. This isn’t just a hypothetical scenario; it’s a multi-trillion-dollar problem that plagues e-commerce, banking, and service industries.

Table of contents

- The High Cost of Friction: Clicks, Forms, and Abandoned Carts

- From Clicks to Conversation: The Rise of Voice-Led Transactions

- Traditional UI vs. Voice-Led Workflow: A Head-to-Head Comparison

- A Step-by-Step Guide to Building Transactional Chatbots for Voice

- Final Thoughts: The Future of Commerce is a Conversation

- Frequently Asked Questions (FAQ)

The High Cost of Friction: Clicks, Forms, and Abandoned Carts

The core of the problem is that traditional digital workflows were designed for machines, not for people. Whether it’s paying a bill, scheduling an appointment, or managing an account, the process is almost always a series of rigid, unforgiving steps.

- It’s Inefficient: Manually entering credit card details, shipping addresses, and personal information is a slow and tedious process.

- It’s Inaccessible: For users who are driving, multitasking, or have physical disabilities, navigating a complex web of menus and forms is often impossible.

- It’s Impersonal: A static web form cannot answer a clarifying question, offer a recommendation, or provide the reassurance a customer needs to complete a high-value transaction.

This friction leads directly to lost revenue, decreased customer satisfaction, and a significant operational burden on human support teams who are left to clean up the mess.

From Clicks to Conversation: The Rise of Voice-Led Transactions

The solution is to fundamentally rethink the transaction process. Instead of forcing users to navigate a machine’s world, we can now build machines that understand ours. This is the power of voice-led transactions, enabled by sophisticated Chatbots for Voice.

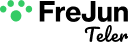

A voice-based transactional chatbot is an AI-powered agent that can listen to, understand, and act upon a user’s spoken commands. It combines several key technologies into a seamless, real-time pipeline:

- Automatic Speech Recognition (ASR): To accurately transcribe what the user is saying.

- Natural Language Understanding (NLU): To decipher the user’s intent (e.g., “pay my bill”) and extract key information (e.g., the amount and the due date).

- Dialogue Management: To guide the user through a multi-turn conversation, asking for any missing information and providing confirmations.

- Backend Integration: To securely connect with payment gateways, CRMs, and other business systems to execute the transaction.

- Text-to-Speech (TTS): To provide a natural, spoken response, confirming the transaction’s success or providing helpful error messages.

While this technology is powerful inside a mobile app, its true potential is unlocked when it’s accessible on the most trusted channel for secure transactions: the telephone. This is where FreJun provides the critical infrastructure. We offer a simple, powerful API that connects your intelligent Chatbots for Voice to the global phone network, allowing your customers to securely pay bills, manage their accounts, and make purchases with the same ease as talking to a human agent.

Traditional UI vs. Voice-Led Workflow: A Head-to-Head Comparison

| Step/Feature | Traditional E-commerce Checkout | Voice-Led Transaction with a Chatbot |

| Initiation | User must manually navigate to the checkout page. | User simply says, “I’d like to buy this.” |

| Data Entry | User manually types shipping address, billing address, and credit card info. | Bot retrieves saved information and asks for verbal confirmation. “Should I ship this to your default address?” |

| Authentication | User types a password or waits for a 2FA code via SMS. | Bot can use secure voice biometrics or send a push notification for approval. |

| Error Handling | A red error message appears for an incorrect field, forcing the user to find and fix it. | Bot provides a helpful spoken prompt: “It looks like that CVV is incorrect. Could you please say it again?” |

| Confirmation | A confirmation page is displayed, which the user must read. | Bot provides a clear, spoken confirmation: “Your order is complete! It will arrive in 3 to 5 business days.” |

| Time to Complete | Several minutes. | Under a minute. |

| User Experience | High friction, impersonal, prone to abandonment. | Low friction, conversational, and builds trust. |

Key Takeaway

The future of digital transactions is conversational. By replacing tedious forms and clicks with a natural, spoken dialogue, Chatbots for Voice dramatically reduce friction, increase conversion rates, and create a far superior customer experience. However, to deploy these high-stakes transactional bots on a channel that customers universally trust, you need an enterprise-grade voice infrastructure. FreJun provides this essential foundation, enabling secure, reliable, and scalable voice-led transactions over the telephone.

A Step-by-Step Guide to Building Transactional Chatbots for Voice

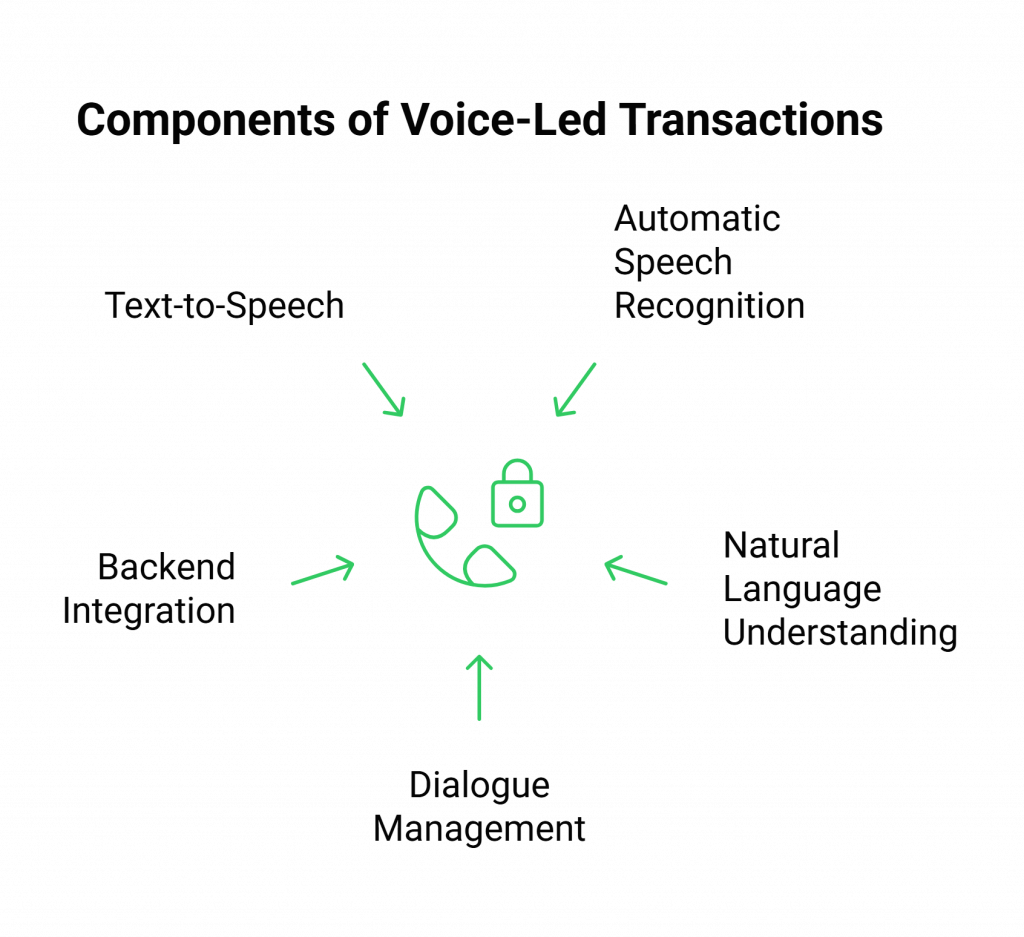

Designing a voice bot that handles sensitive transactions requires a meticulous focus on security, clarity, and user trust. This is more than just a standard Q&A bot; it’s a virtual agent that acts on behalf of your customer. Here are the critical steps and best practices to follow.

Step 1: Design for Intent and Data Capture

First, map out the specific transactional intents your bot will handle (e.g., make_payment, transfer_funds, update_billing_info). For each intent, define the “slots” or pieces of information required to complete the action (e.g., amount, recipient, card number). Your dialogue manager’s primary job will be to guide the conversation to fill these slots.

Step 2: Prioritize Security with Multi-Factor Authentication

Never rely on a single piece of information to authorize a transaction. Your Chatbots for Voice must have robust user verification. This can include:

- Asking for a PIN or a piece of personal information.

- Using secure voice biometrics to verify the speaker’s identity.

- Sending a push notification to a trusted mobile device for a one-tap approval.

Step 3: Build in Explicit Confirmations

Before executing any irreversible action, the bot must get explicit confirmation from the user. This is a critical trust-building step. For example:

“Okay, I’m ready to transfer $50 from your checking account to Jane Doe. Is that correct?”

This simple step prevents errors and gives the user complete control over the process.

Step 4: Design a Seamless Escalation Path

No bot can handle every scenario. What if a user’s request is too complex, or they are simply too frustrated to continue with the AI? A critical part of any transactional Chatbot for Voice is the ability to seamlessly escalate to a human agent. The bot should be able to recognize when it’s out of its depth and offer a transfer.

With FreJun, this handoff is seamless. The bot can transfer the live call, along with the full conversation context directly to a human agent, so the user never has to repeat themselves.

Step 5: Ensure Regulatory Compliance

If your bot is handling payments, it must be compliant with industry standards like PCI DSS (Payment Card Industry Data Security Standard). This means ensuring that sensitive information like credit card numbers is handled securely and is not stored in your chat logs. Partnering with a voice infrastructure provider that understands these requirements is essential.

Final Thoughts: The Future of Commerce is a Conversation

The way we buy, pay, and manage our accounts is on the cusp of a revolution. The era of clunky forms and frustrating checkout processes is coming to an end. The future is conversational, and businesses that embrace this shift will be the ones who win the loyalty of their customers. Building intelligent Chatbots for Voice is the key to unlocking this future.

Real-world examples from institutions like U.S. Bank and Bank of America are already proving the power of this technology. Customers can now manage their finances with the same ease as talking to a teller. This level of convenience and efficiency is no longer a luxury; it’s the new standard.

However, a truly enterprise-ready solution requires more than just a smart AI. It requires a rock-solid, secure, and scalable foundation. To deploy these high-stakes bots on a channel that your customers have trusted for decades, you need an infrastructure partner you can trust. FreJun provides the simple, powerful, and reliable API that allows you to confidently step into the future of voice-led commerce.

Don’t just build a product. Build a conversation.

Further Reading –Build a Conversational AI Voice Bot from Backend APIs

Frequently Asked Questions (FAQ)

When implemented correctly, they can be very secure. Security relies on robust, multi-factor authentication methods. This is why a simple in-app bot is often not enough; a secure telephony layer is crucial for high-stakes transactions.

Yes. As demonstrated by leading banks, a well-designed Chatbot for Voice, integrated with the bank’s secure backend systems, can handle a wide range of transactions, from balance inquiries to fund transfers.

A well-designed bot will have clear error-handling and fallback strategies. It might ask for clarification (“I’m sorry, I didn’t quite catch that. Could you please repeat the amount?”) or, after a few failed attempts, offer to connect the user to a human agent.

No. A wide range of conversational AI platforms and APIs are available that provide the NLU and dialogue management capabilities needed for a transactional bot. The key is to integrate these with your secure backend systems and a reliable voice infrastructure provider.

FreJun provides the essential voice infrastructure layer. While other platforms help you build the bot’s AI “brain,” FreJun provides the “body” that connects that brain to the global telephone network. This is critical for creating a true omnichannel experience where the same intelligent bot that helps a user in your app can also securely handle their phone call.