The screech of tires, the jolt of impact, the sinking feeling in your stomach. A car accident is a deeply stressful event. But for many, the stress of the incident is only the beginning. What follows is often a confusing and frustrating journey of filing an insurance claim, a process filled with long hold times, repetitive questions, and the anxiety of the unknown.

For insurance carriers, this critical first interaction, known as the First Notice of Loss (FNOL), is their single most important opportunity to build trust. Yet, it is often where the customer experience breaks down. This is where a modern, empathetic AI voicebot can transform the entire process.

The stakes for getting the claims experience right are incredibly high. Research from McKinsey shows that customers who are satisfied with the claims process are 84% more likely to renew their policies.

By automating and streamlining the initial claims intake with conversational AI, insurance companies can turn a moment of crisis for their customers into a moment of reassurance, building loyalty and driving business growth. This article explores how an AI voicebot is revolutionizing auto insurance claims.

Table of contents

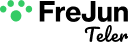

Why is the Traditional Claims Process So Painful?

The traditional method of reporting an auto insurance claim is a process that has not changed much in decades, and it is riddled with friction for an already distressed policyholder. When a customer calls to report an incident, they are often met with a complicated phone tree, followed by a long wait on hold.

When they finally connect with a human agent, the process of gathering information begins. The policyholder must recount the details of a traumatic event, often multiple times, as they are transferred between departments. This manual data entry process is not only slow but also prone to human error.

A misspelled name, an incorrect policy number, or a misunderstood detail can cause significant delays downstream, prolonging the claims cycle and adding to the customer’s frustration.

Furthermore, accidents do not happen on a 9 to 5 schedule. A customer who has an accident late at night or on a weekend is forced to wait until the next business day to even start the process, leaving them in a state of uncertainty when they need help the most.

This outdated, inefficient system creates a poor customer experience and sets a negative tone for the entire claims journey.

Also Read: Why Reliability Matters in Voice AI Calls?

How Does an AI Voicebot Revolutionize the Claims Process?

An AI voicebot completely reimagines this first point of contact. It acts as a dedicated, infinitely patient, and instantly available claims intake specialist. It is designed to handle the FNOL process with a level of speed, accuracy, and empathy that is simply not scalable with a purely human team.

When a policyholder calls, they are immediately greeted by a calm, conversational AI. This is not a clunky, robotic IVR. A modern AI voicebot uses advanced natural language processing to understand the caller’s needs and can have a fluid, two way conversation.

It can be programmed to use an empathetic tone, saying things like, “I understand this is a difficult time. I’m here to help you get this process started quickly and easily. First, are you and everyone involved safe?”

The AI then guides the caller through the information gathering process in a structured, conversational way. It can ask for key details such as:

- The policyholder’s name and policy number.

- The date, time, and location of the incident.

- A brief description of what happened.

- Information about other vehicles or parties involved.

This entire conversation is powered by a seamless flow of information. For the interaction to feel natural and not frustrating, the audio must be streamed in real time without any lag. This is where the underlying infrastructure is critical.

A platform like FreJun AI provides the low latency voice transport layer, ensuring that when the customer speaks, the AI understands instantly, and its response is heard immediately.

This eliminates the awkward pauses that make older automated systems feel so unnatural and makes the AI voicebot a truly effective conversational partner.

What Are the Key Benefits for Insurance Companies?

Implementing an AI voicebot for claims intake is a strategic move that provides a powerful return on investment. It improves operational efficiency, reduces costs, and most importantly, creates a customer experience that drives loyalty.

According to Accenture, AI has the potential to add up to $7 billion in value to the insurance industry annually, primarily through automation and increased efficiency. Here is a look at the direct impact of an AI voicebot on the claims process:

| Metric | Traditional Manual Process | Process with an AI Voicebot |

| Availability | Limited to call center business hours. | 24 hours a day, 7 days a week, 365 days a year. |

| Wait Time | Often involves long hold times during peak hours. | Instantaneous, zero hold time. |

| Call Duration | Longer, due to manual data entry and potential holds. | Shorter and more efficient, with automated data capture. |

| Data Accuracy | Susceptible to human error in manual transcription. | Highly accurate with structured data capture and validation. |

| Scalability | Limited by the number of available human agents. | Infinitely scalable to handle sudden surges in call volume. |

| Agent Focus | Agents spend most of their time on repetitive data entry. | Agents are freed up to handle complex, high empathy cases. |

By automating the front end of the claims process, an AI voicebot allows human claims adjusters to focus on the more complex, value added aspects of their jobs. They can spend their time investigating the claim, communicating with body shops, and providing a human touch where it matters most, rather than just being data entry clerks.

Ready to automate your claims intake and elevate your customer experience? Sign up for FreJun AI and explore our powerful voice APIs.

Also Read: Enterprise-Grade Voice Infrastructure Explained

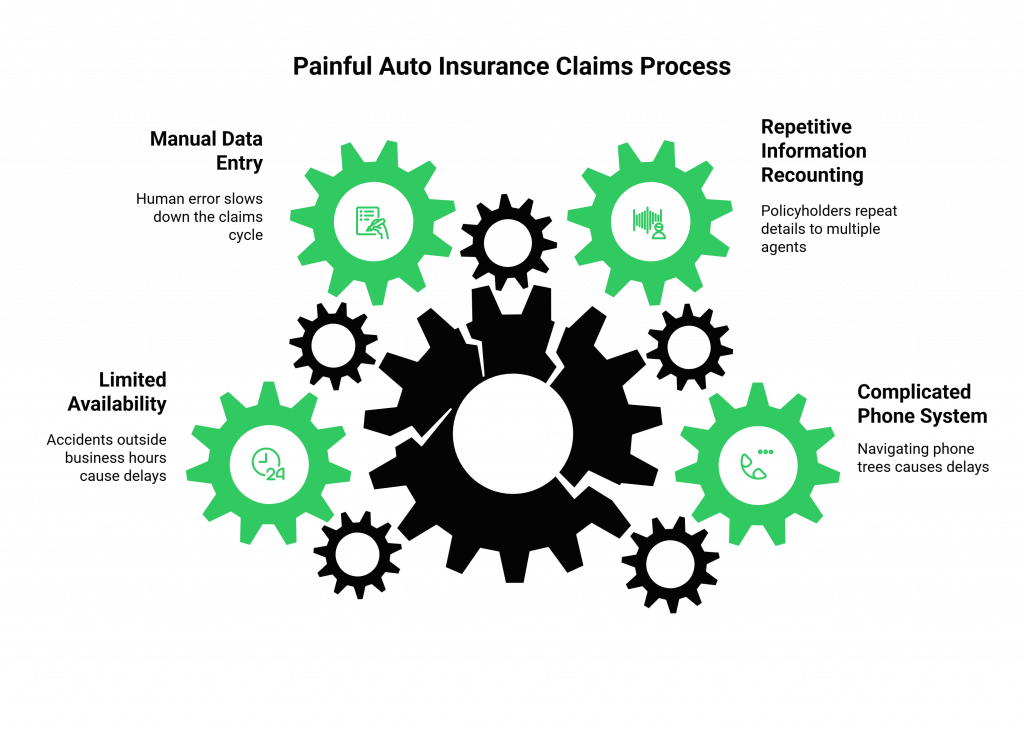

How Do You Implement an AI Voicebot for Claims?

Deploying a sophisticated AI voicebot for your claims department involves a few key technological and strategic steps. It is about building an intelligent system on a reliable foundation.

First, you need to integrate the voicebot with your core insurance systems. This means connecting it via APIs to your policyholder database and your claims management platform. This integration allows the AI to verify a caller’s identity and directly file the initial claim information into your system of record.

Second, you must design the conversation. This is the most crucial step in ensuring a positive customer experience. You will work with developers to script the conversation flow, defining the questions the AI voicebot will ask, how it should respond to different customer answers, and what its overall tone and personality should be.

Third, you will select your AI technology stack. This includes a Speech-to-Text (STT) engine, a Large Language Model (LLM), and a Text-to-Speech (TTS) engine. This is where the flexibility of your voice infrastructure provider becomes a major advantage.

A model agnostic platform like FreJun AI allows you to choose the best in class AI models for your specific needs. For example, you could select an LLM that is specially trained on insurance terminology or a TTS voice that has been tested to be the most calming for distressed callers.

Finally, you need to build this entire solution on an enterprise grade voice infrastructure. Reliability and security are non negotiable when handling sensitive customer information. FreJun AI provides the robust “plumbing” to handle high call volumes with guaranteed uptime, ensuring that your AI voicebot is always available when your customers need it most.

Also Read: How to Maintain Call Quality in Voice AI?

Conclusion

The auto insurance claims process is the moment of truth in the relationship between an insurer and its customer. A slow, frustrating experience can break that trust forever, while a fast, empathetic, and efficient experience can build a customer for life. The traditional, manual approach to claims intake is no longer sufficient to meet modern customer expectations.

An AI voicebot provides a powerful solution, transforming the First Notice of Loss into a seamless, reassuring, and instant process. It empowers insurance companies to be there for their customers 24/7, providing immediate assistance and starting the claims journey on the right foot.

By adopting this technology, insurers can not only achieve significant operational efficiencies but also deliver the superior customer experience that is the key to long term success. An intelligent AI voicebot is no longer a futuristic concept; it is the new standard for insurance claims.

Want to see how an AI voicebot can be tailored for your specific claims workflow? Schedule a demo with our team at FreJun Teler.

Also Read: How to Log a Call in Salesforce: A Complete Setup Guide

Frequently Asked Questions (FAQs)

It is a conversational AI program that can handle the initial phone call from a policyholder to report a claim. It can understand natural speech, gather all the necessary information about the incident, and file the First Notice of Loss (FNOL) automatically.

A basic IVR (Interactive Voice Response) uses a rigid “press one for this, press two for that” menu. An AI voicebot is conversational. It uses AI to understand the user’s spoken sentences and can have a flexible, two way dialogue.

No, its purpose is to augment them. The AI voicebot handles the high volume, repetitive task of initial data collection, which frees up human agents to focus on the more complex and empathetic aspects of managing the claim.

The AI is guided by a carefully designed conversation flow. It asks specific, structured questions to gather the details it needs. For highly complex or emotional situations, it can be programmed to seamlessly transfer the call to a human agent.

Yes. A platform like FreJun AI is built with enterprise grade security by design. It uses robust encryption and security protocols to ensure that all sensitive policyholder information is protected and kept confidential.

Absolutely. By integrating with the appropriate AI models, the voicebot can be configured to communicate fluently in multiple languages, providing better service to a diverse customer base.